Supercharge Your Mortgage Renewal In Ontario

Let's talk about the $15 billion elephant in the room as CMHC estimates

more than 2.2 million mortgage borrowers in Canada

will be up for renewal in 2024 and 2025.

This has left hundreds of thousands of Canadians bracing for their mortgage renewal and

wondering if they'll be able to afford their home when their term is up.

See, most mortgages in Canada renew after a 5-year term.

If you're one of my American 🇺🇸 readers, this can be a shock if you're used to locking in until you sell.

But 5 years ago, rates were unprecedentedly low....

allowing Canadians to borrow more money to afford their home.

Now that they've spent the last few years acclimatizing to their monthly mortgage payments,

the two-thirds of Canadians who chose a fixed rate have this looming increase in their mortgage payments.

If you're one of those who chose a variable rate, you've been feeling that pressure the last 2 years

and have likely been adjusting your spending or using your savings to help cover

the fluctuating costs of your mortgage payment.

The interest rate shock for those in a fixed rate is looking to be an

estimated increase of around 35% monthly

depending on what rates were when you secured your mortgage.

So, if this sounds like your situation, hang tight because we'll be covering

what you can do right now to help mitigate the impact of your renewal.

But before we dive into those tips....

Let's chat a bit about interest rates,

how they are established,

& what the impact has been.

So to start, I want to introduce you to Eric Sabatini - a mortgage agent here in Ontario.

Helping to educate people about their mortgage options is a huge part of his day-to-day business!

He's going to be helping us truly understand the options people have,

but for specific advice, I encourage you to reach out and book a consultation with Eric.

Now, some background to help get you up to speed:

The Bank of Canada has been raising and occasionally holding rates since March 2022.

In fact, there have been 10 rate hikes since March 2022, bringing us to

the 5% that the bank has held since July 12th, 2023.

So, why did the rates have to increase so quickly?

The Bank of Canada needed to break inflation down,

and the best tool they have is increasing interest rates to

reduce spending, which in turn brings inflation down.

Since it takes time for these measures to work, the Bank of Canada has been holding rates the

last five announcements so that the previous rate hikes have time to bring inflation down.

Now, if you're on a variable-rate mortgage and it's hard to cover your mortgage payments, you do have options.

Let's hear from Eric what your variable rate options are.

But keep in mind, the big six Bank CEOs in Canada are all predicting rate

declines by the end of this year, so if you can keep holding on, there should be relief in the near future.

ERIC - Those grappling with variable rate mortgages

and feeling the pinch of making ends meet do have options.

First off, I want you to think about your own situation for a second...

How dire are things for you?

Can you hold on to your variable rate a little longer

just to see if rates begin to decrease in the near future?

If not, here are a couple of tips for how you could deal with your variable rate struggles at the moment.

Option Number One: Lock It In

Variable rate clients always have the option to lock into a fixed rate.

As of today, the fixed rate offered to you will likely be lower than your

current variable rate, therefore payment relief is possible.

The risk you run is that by locking in now, you may lose out on the

opportunity to take advantage of potential rate drops expected in the near future.

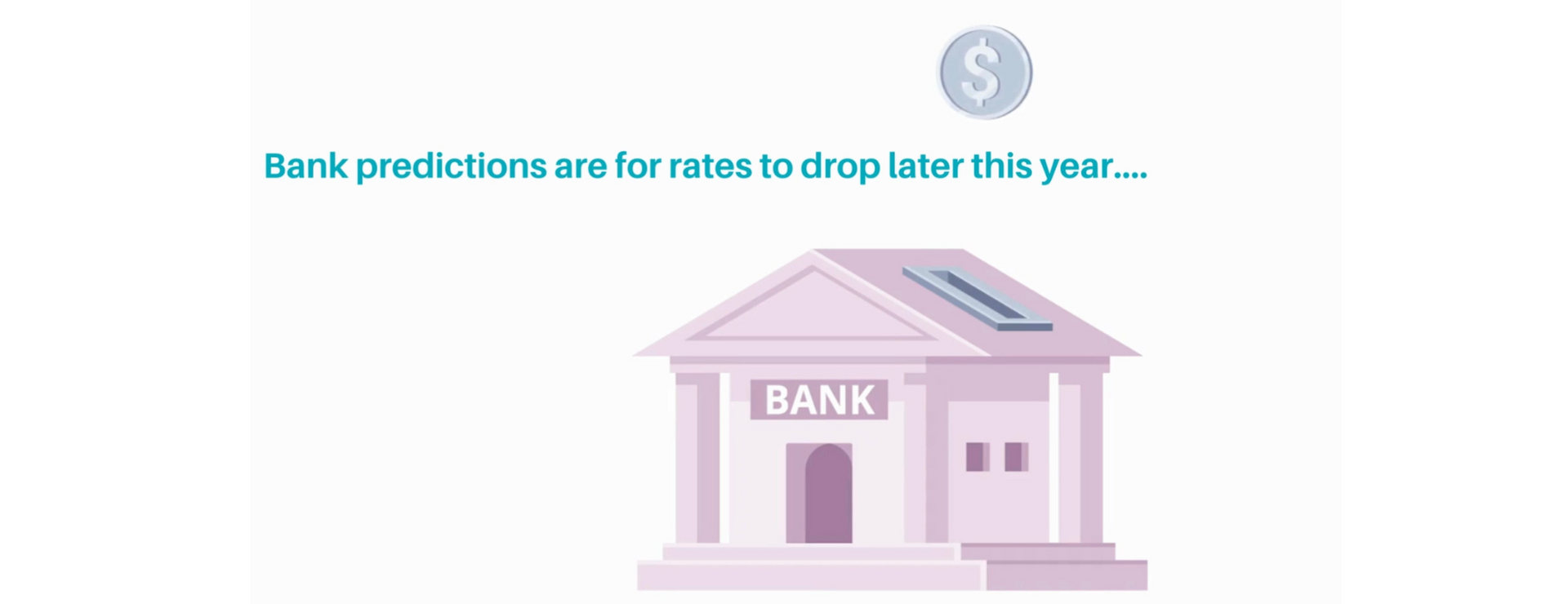

Option Two: Payment Frequency

You can also look at your payment frequency and how you make payments.

So if you're paying monthly, consider switching to what they call a regular bi-weekly payment.

So with a bi-weekly mortgage payment,

you make 26 payments per year,

so it sometimes feels easier for people to budget each month.

Number Three: Break & Refinance

So if you're struggling and you want to look into breaking your mortgage to,

let's say, consolidate some debt, you will face a prepayment penalty.

So a prepayment penalty is a lender's return policy

when you break your mortgage before the term is up.

One of the benefits of taking a variable rate is its flexibility.

When you break a variable rate mortgage,

the penalty is always 3 months of interest added up.

This is a flexible penalty, and it's often a lot less than if you had a

fixed-rate and wanted to break it before your term was up.

Each situation is unique and therefore customizable.

These three options are not always possible for every borrower...

What's most important here is that you educate yourself

on the options so you can make a stronger, more informed,

knowledgeable decision about your greatest asset.

As for people on a FIXED MORTGAGE,

the rates are calculated a bit differently.

One component that often remains shrouded in mystery

is how fixed-rate mortgages are actually set in Canada.

Here's a little spoiler:

It all goes back to the 5-year Government of Canada Bond yield.

What is the 5-year bond yield, you ask?

I want you to imagine that you have money saved up,

and you want to invest it somewhere safe so that it can grow.

One option available to you is to lend your money

to the Government. This is the 5 Year Canada Bond Yield.

So, an investor lends money to the government &

the government offers a

guaranteed rate of return... after 5 years.

Since the Bond Yield is backed by the government of Canada

& considered supremely secure, Banks & Lenders use

the Bond Yield as a reference point for coming up with the fixed rates

you see advertised on mortgages.

So, an easy way to understand it is this:

When bond yields go up, banks typically raise fixed mortgage rates.

Conversely, when they go down, so too can the rates offered to you by these banks and lenders.

Now, I get this question a lot: Eric, is this just fixed rates, not variable?

So, while bond yields affect fixed rates, they don't directly impact variable rates.

Variable rates are influenced by the Bank of Canada's policy interest rate.

This is akin to the throttle of our country's economic engine.

So, when the economy needs a little bit of a jolt,

the rate drops, making borrowing cheaper.

Should the economy overheat and need cooling, as evidenced by the past two years,

the Bank of Canada raises rates with the intent to slow down demand for borrowing and spending.

So, taken as a whole, as a potential buyer or even an existing homeowner,

grasping this aspect of your mortgage is super crucial.

By embracing this knowledge, you actually empower yourself

with the foresight to navigate the path to homeownership properly.

- TIPS FOR SUCCESSFUL RENEWAL -

ROCHELLE - Now, when it comes to your mortgage being up for renewal,

there are some things you should do now to set yourself up for success.

But first, I want you to know that historically,

Canadians will often do whatever it takes to keep their mortgage paid.

Many reduce spending in other areas...

forgo payments on credit cards,

avoid loan repayments,

& sometimes even quit paying their utilities...

Just to ensure the mortgage is paid.

So, if you're struggling, know that you are not alone,

but use these tips to help you get through the renewal in the best way possible!

ERIC - Here are my top three tips for anyone preparing for a renewal this year or into 2025.

Before delving into the world of mortgage renewals,

it's crucial to take stock of your current financial status.

Has your income changed at all?

Are you facing increased expenses,

or are you planning future investment opportunities?

Do you simply want to renew and keep your mortgage balance the exact same?

Do you want to extend your amortization to make your monthly payments more manageable,

or are you considering a refinance to pay some higher interest debts?

The point is, your current situation... your budget, your debts, your monthly cash flow, etc....

It all needs to be assessed precisely to ensure that the mortgage product,

the rate, the fine print, and the term length you choose fits your life appropriately.

Do not sign on the dotted line when a lender sends you a renewal letter in the mail.

It is often autogenerated by a computer and printed weeks before you even receive it.

The mortgage marketplace changes DAILY!

That renewal letter is not taking into consideration any of those changes since it was printed.

Signing that piece of paper blindly without speaking to somebody about the

details or the fine print can put you in a worse-off position overall.

I want you to start EARLY.

Mark your calendar for 4 months or 120 days before your mortgage maturity date.

This is when you can lock in a new fixed mortgage rate or a variable rate promotion.

As I said, the mortgage marketplace changes daily.

Get your renewal or refinance locked in early,

then ensure your mortgage pro is tracking things like the 5-year Canada bond yield,

the Bank of Canada decisions, and overall economic forecast because

he or she can work on getting that rate lower if possible over the next 120 days.

And what's more, if rates increase over that 4-month period,

at least you locked in a lower rate well in advance.

So, now that you know what you can do to put yourself in the best position for your upcoming mortgage renewal, we understand that for some of you, you may decide selling is your best option for the long term.

There are a lot of potential outcomes when you sell...

From finding something smaller or less costly to maintain,

to choosing to rent and focus on other investment strategies,

to bringing in a housemate to help make life more affordable.

If renewing isn't an option for you, I'm happy to connect

and help you process what the best strategy is for you.

The Genuine Blog